Subtotal $0.00

More than 140 countries have committed to implement a new global tax agreement aimed at ensuring multinational companies pay a minimum rate of tax.

The deal, which was proposed by the Organisation for Economic Co-operation and Development (OECD), imposes a minimum effective rate of 15% on corporate profits. The policy is aimed at ending the benefit of shielding multi-billion-dollar profits in tax havens. It is also intended to remove the incentive for nations that operate as tax havens for corporate giants.

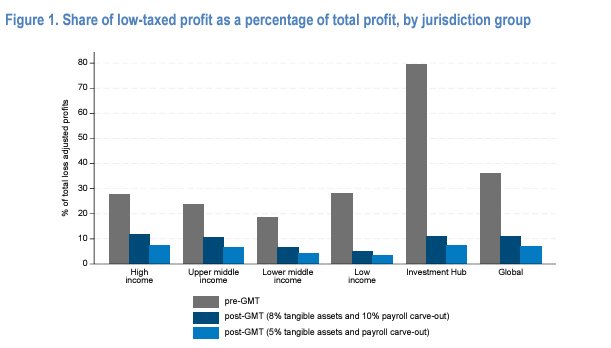

The OECD estimates the Global Minimum Tax (GMT) policy will reduce under-taxed profits by around 80%, as it applies across geographies, national income boundaries and tax haven structures.

Closing tax loopholes

The GMT seeks to end the practice of multinational companies shifting profits to low-tax countries and territories, even though the income was generated elsewhere. The Financial Times explains that, under the GMT agreement, if a country levies a tax rate below 15% other countries will be able to impose a top-up tax that brings the total up to the minimum level.

Countries that have previously operated as tax havens, including Ireland, Luxembourg, Switzerland and Barbados, are implementing the minimum rates, according to the Financial Times.

Comments are closed